The Custom Private Equity Asset Managers Ideas

Wiki Article

Excitement About Custom Private Equity Asset Managers

(PE): investing in business that are not publicly traded. About $11 (https://www.twitch.tv/cpequityamtx/about). There may be a few things you do not understand about the market.

Exclusive equity companies have a range of financial investment choices.

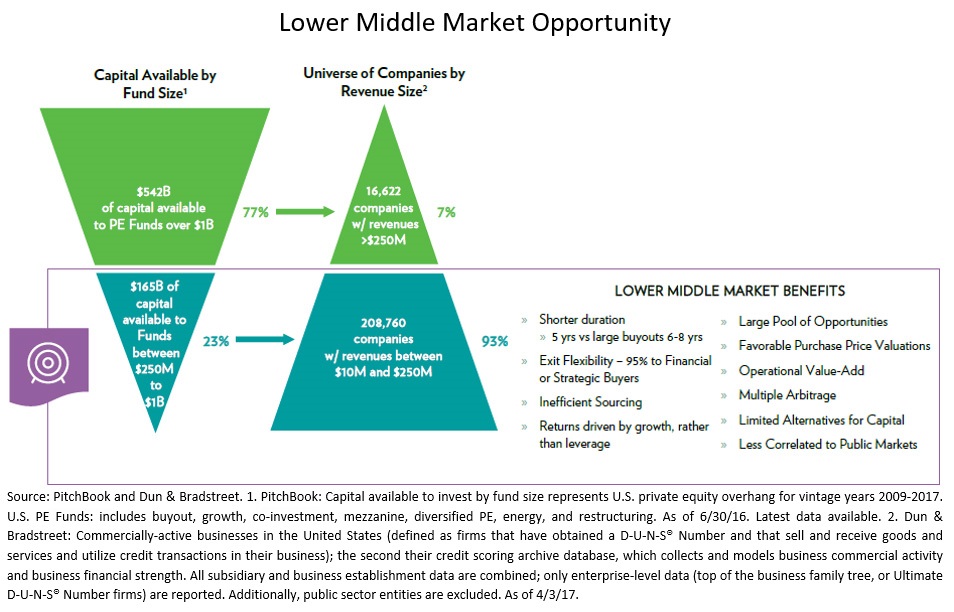

Because the very best gravitate towards the larger offers, the middle market is a considerably underserved market. There are much more sellers than there are extremely seasoned and well-positioned finance professionals with extensive customer networks and resources to manage an offer. The returns of private equity are usually seen after a couple of years.

All About Custom Private Equity Asset Managers

Traveling below the radar of large multinational companies, many of these small firms often provide higher-quality customer care and/or particular niche product or services that are not being provided by the large conglomerates (https://forums.hostsearch.com/member.php?252921-cpequityamtx). Such benefits attract the passion of exclusive equity firms, as they possess the insights and wise to exploit such chances and take the business to the next degree

The majority of managers at profile firms are given equity and bonus settlement frameworks that award them for striking their financial targets. Private equity possibilities are typically out of reach for individuals who can't spend millions of dollars, however they shouldn't be.

There are guidelines, such as limitations on the accumulation quantity of money and on the variety of non-accredited financiers. The exclusive equity company draws in several of the ideal and brightest in corporate America, including leading entertainers from Fortune 500 companies and elite administration consulting firms. Law office can also be hiring premises for personal equity hires, as accounting and legal skills are necessary to total offers, and transactions are very searched for. https://cpequityamtx.mystrikingly.com/blog/unlocking-opportunities-custom-private-equity-asset-managers-in-texas.

Facts About Custom Private Equity Asset Managers Uncovered

One more negative aspect is the lack of liquidity; as soon as in a private equity transaction, it is challenging to obtain out of or offer. There is an absence of flexibility. Exclusive equity likewise comes with high charges. With funds under management already in the trillions, personal equity companies have actually ended up being eye-catching investment vehicles for wealthy individuals and institutions.

For decades, the features of personal equity have actually made the possession course an attractive proposal for those that might take part. Currently that access to private equity is opening as much as more individual investors, the untapped possibility is becoming a reality. So the concern to consider is: why should you invest? We'll start with the primary debates for purchasing private equity: How and why personal equity returns have historically been greater than various other possessions on a variety of degrees, How including personal equity in a portfolio influences the risk-return account, by helping to branch out against market and intermittent threat, Then, we will outline some key factors to consider and dangers for personal equity capitalists.

When it involves presenting a brand-new possession right into a profile, one of the most fundamental consideration is the risk-return account of that property. Historically, exclusive equity has shown returns comparable to that of Arising Market Equities and higher than all other conventional property classes. Its fairly reduced volatility combined with its high returns makes for an engaging risk-return account.

Fascination About Custom Private Equity Asset Managers

In truth, personal equity fund quartiles have the largest variety of returns across all alternate possession courses - as you can see below. Methodology: Inner rate of return (IRR) spreads determined for funds within classic years separately and then balanced out. Median IRR was calculated bytaking the average of the median IRR for funds within each vintage year.

view

The effect of including exclusive equity into a portfolio is - as constantly - reliant on the profile itself. A Pantheon study from 2015 recommended that including personal equity in a profile of pure public equity can open 3.

On the various other hand, the ideal personal equity firms have accessibility to an even bigger pool of unidentified chances that do not deal with the exact same scrutiny, as well as the resources to perform due diligence on them and identify which are worth purchasing (Asset Management Group in Texas). Investing at the very beginning means greater threat, but also for the companies that do prosper, the fund advantages from greater returns

The Facts About Custom Private Equity Asset Managers Revealed

Both public and private equity fund supervisors dedicate to spending a portion of the fund yet there remains a well-trodden concern with straightening interests for public equity fund administration: the 'principal-agent problem'. When a capitalist (the 'principal') works with a public fund supervisor to take control of their resources (as an 'representative') they hand over control to the manager while retaining possession of the properties.

In the case of personal equity, the General Partner does not simply earn a management charge. Exclusive equity funds likewise alleviate an additional kind of principal-agent issue.

A public equity investor ultimately desires something - for the management to increase the supply price and/or pay rewards. The financier has little to no control over the decision. We revealed above the amount of exclusive equity approaches - particularly bulk acquistions - take control of the running of the business, guaranteeing that the lasting worth of the business precedes, pushing up the return on investment over the life of the fund.

Report this wiki page